Stay updated on interest rates today. Discover the latest changes, factors influencing rates, and tips on managing your finances.

Interest Rates Today: Latest Updates and Market Trends

Introduction

Keeping track of interest rates is essential for making informed financial decisions. Whether you’re considering a mortgage, personal loan, or investment, understanding current rates can help you optimize your financial strategies.

Why Are Interest Rates Important?

Interest rates influence various aspects of the economy and personal finance:

-

Loan Costs: Higher rates mean more expensive loans.

-

Savings Returns: Increased rates can boost returns on savings accounts.

-

Investment Decisions: Rate changes can impact stocks, bonds, and real estate.

-

Economic Indicators: Rates reflect the state of the economy, inflation, and central bank policies.

Latest Updates on Interest Rates Today

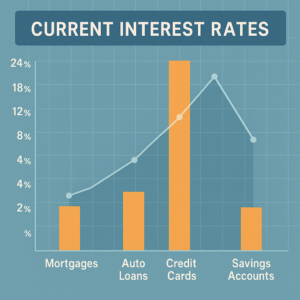

As of today, the average interest rates for key financial products are:

-

Mortgages: Around 6.5% for 30-year fixed rates.

-

Personal Loans: Typically ranging from 8% to 36% depending on credit scores.

-

Auto Loans: Around 5% for new cars.

-

Credit Cards: Averaging 20% APR.

-

Savings Accounts: Offering around 4% APY with high-yield options.

(Note: Rates may vary based on location, lender, and individual credit profiles.)

Factors Affecting Interest Rates

Several factors contribute to the rise and fall of interest rates:

-

Federal Reserve Policies: Adjustments to control inflation and stimulate the economy.

-

Economic Data: Employment rates, GDP growth, and inflation reports.

-

Market Sentiment: Investor confidence and risk appetite.

-

Global Events: Political stability and international trade policies.

Tips to Manage Your Finances Amid Changing Rates

-

Refinance Loans: Lower your monthly payments if rates decrease.

-

Lock-In Fixed Rates: Prevent rate hikes from affecting long-term loans.

-

High-Yield Savings: Move your money to accounts offering better returns.

-

Debt Repayment: Pay off high-interest debt faster to save on interest charges.

-

Diversify Investments: Balance between fixed-income assets and variable-rate opportunities.

How to Find the Best Interest Rates Today

-

Compare Lenders: Use online comparison tools to find the best rates.

-

Check Credit Scores: Better scores often lead to lower rates.

-

Consult Financial Advisors: They can guide you based on current market trends.

-

Stay Updated: Regularly check reliable financial news sources.

What Does the Future Hold for Interest Rates?

Experts predict that interest rates may continue to fluctuate due to ongoing economic challenges. It’s crucial to:

-

Monitor Federal Reserve Announcements: Policy changes can significantly affect rates.

-

Watch Inflation Data: Persistent inflation may lead to higher rates.

-

Stay Informed: Read financial news and expert analysis regularly.

Frequently Asked Questions

Q: How often do interest rates change?

A: Rates can change frequently, especially with shifts in the economic landscape or central bank policies.

Q: Should I refinance my mortgage now?

A: If current rates are significantly lower than your existing mortgage rate, it may be beneficial.

Q: Are fixed-rate loans better than variable rates?

A: Fixed rates offer stability, while variable rates may save money if interest rates drop.

Final Thoughts

Understanding interest rates today is crucial for managing loans, savings, and investments. Stay informed and make strategic financial decisions to maximize your benefits.

What are your thoughts on today’s interest rates? Share your insights in the comments!